It is important to learn how money and time are related to each other by every individual. This is one of the essential for financial literacy. Money has its own time value, it can be explained in terms of Present Value and the Future Value.

This is applicable to cash flows(money) for both borrowed as well as invested.

If you have ever borrowed money you would have observed that what you pay back is more than the borrowed, that is because of the interest added to it.

The actual borrowed money is the present value, what you will pay back is the future value.

Same like what you invest today (present value) in a particular savings instruments fetches you a higher return (future value)

The interest rates work in a compounded fashion. It is up to you whether you want time to work in your favour or the odds.

Read this article further to understand,

How to calculate PV and FV easily in a Google Sheet?

As mentioned above there can be two scenarios. One, money borrowed from lending sources.

What happens if Money borrowed,

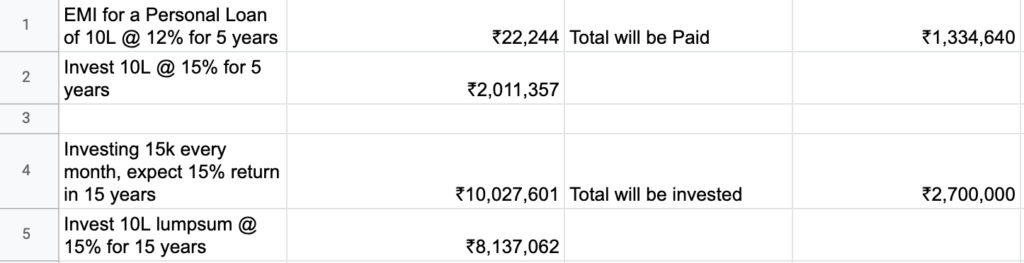

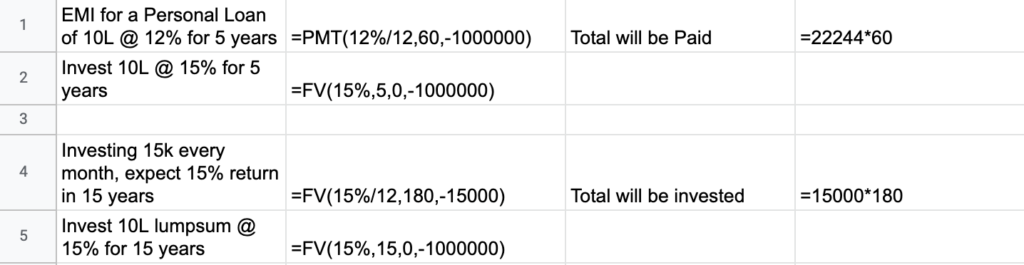

Row 1:

In this case suppose a person has taken a loan for 10 Lakh at an interest rate of 12% for 5 years. He would have paid 13,34,640/- (Thirteen lakh thirty-four thousand six hundred and forty) to settle it.

This is calculated by using the formula PMT which will give the monthly interest payment towards the loan schedule. Multiply the EMI amount by 60 months to arrive at the final value. The same reference is shown in the image below.

Row 2:

Instead, if the person has invested a same amount of 1000000/- (Ten lakh) at 15% return yield for 5 years then his investment would have become 20,11,354/- (Twenty lakh eleven thousand three hundred and fifty four).

Formula in Cells,

Case of Money Invested,

The second case, spending money for investing.

Row 3:

Consider an investment of 15000/- every month for 15 years with an expected annual return of 15%, this shall yield 1,00,27,601 (One crore twenty-seven thousand six hundred and one)

The formula used is FV (Future Value), the first argument is the interest rate per month, hence divide 15% by 12.

One more case for investment as in lumpsum,

Row 4:

Consider a one time investment of 1,00,000/- (One Lakh) for 15 years with return expectation of 15%, this will yield 81,37,062/- (Eighty one lakh thirty-seven thousand and sixty two)

The interest scenario in all of the above scenario works in compounded fashion. The effect of compounding is larger if the duration is lengthier, be it for borrowing or investing.

This effect is usually termed as “power of compounding”, and always it is wise to use it for man’s best advantage. A caution on this article, you shall rule out the calculation (formula) part that is completely fine. Just understand the meaning and outcome of those calculations.

To improve your financial prudence and achieve financial freedom check here for financial advisory and AMFI certified mutual fund distributor Ganesan Thiru, he is author of 3 books Money Leaks, 1 Page Mutual Fund Plan & 1 Page Stock Market Plan.